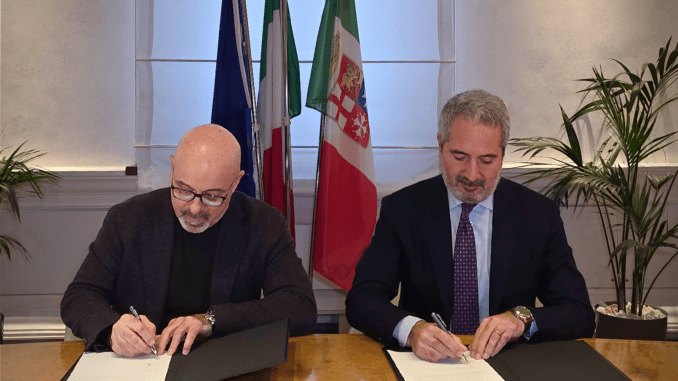

Leonardo announced today that it has completed the sale of its Underwater Armaments & Systems (UAS) business line to Fincantieri.

Under the binding agreement signed on May 9, 2024, at the time of closing, Leonardo received a payment of €287 million, based on the fixed Enterprise Value component of €300 million. The variable component, up to a maximum of €115 million, along with standard price adjustments, will be determined following the approval of UAS’s final 2024 financial results. The total maximum Enterprise Value is €415 million.

Underwater Armaments Systems

Whitehead Alenia Sistemi Subacquei S.p.A., a historic 100% subsidiary of Leonardo, was founded as a company specializing in the construction of submarine defense systems and in particular torpedoes, countermeasures, and sonars. In early 2016, the company merged into Leonardo S.p.A., becoming a business line, and was renamed “Underwater Armaments & Systems” (“UAS”). The business line also includes a 50% participation in GEIE EuroTorp (established with Naval Group and Thales), dedicated to the design and construction of the MU90 light torpedo, and is located in two locations, Livorno and Pozzuoli. In 2023, the UAS line of business generated revenues of approximately €160 million and an EBITDA of €34 million.

Advisors

For the transaction, Leonardo was assisted by Rothschild & Co as financial advisor, by Studio Cappelli RCCD as legal advisor, and by PwC in the preparation of the financial documentation of the business unit. UBS supported Leonardo’s Control and Risks Committee in evaluating the transaction, providing a fairness opinion on the economic terms of the transaction.

Related Party Transaction

For Leonardo, the above Transaction, given the correlation relationship between Leonardo and Fincantieri (both companies controlled by the Ministry of Economy and Finance), is a Related Party Transaction of “lesser importance” pursuant to current regulations and the Company’s Procedure. The Transaction was approved by the Leonardo’s Board of Directors following a reasoned and unanimous favorable, non-binding, opinion expressed by the Control and Risks Committee in the exercise of the relevant functions as Committee for Related Parties Transactions, regarding the Company’s interest in the Transaction.

Be the first to comment